Giles Parkinson, reneweconomy.com.au

The attempt by the Abbott government to stop the Clean Energy Finance Corporation from providing finance for rooftop solar is likely to make it more expensive for those people who have yet to install the technology, and who cannot afford to buy the systems outright.

The Abbott government has directed the CEFC to stop funding rooftop solar – as well as wind turbines – in a controversial move to limit the options available to the green bank, which it wants to shut down.

The Coalition has justified this by arguing that rooftop solar and wind energy technology is ‘mature’, and that rooftop solar is already on the roofs of 1.4 million homes, with more than 4.3GW of capacity installed on households and businesses. It does not need any more help, it argues.

But the CEFC says that while the technology may be ‘mature’, the financing of the uptake of that technology is not mature. And the overwhelming majority of households and businesses have not yet installed rooftop solar, and most of these may not have done so because they can’t afford the upfront payments.

That makes the cost of finance critical. And it is that cost that the CEFC has been trying to reduce.

Simon Brooker, the executive director of corporate and project finance at the CEFC, told an event hosted by the NSW government on Wednesday that financing could have a major impact on costs for new solar customers.

‘The technology might be mature, but the financing is not,’ Brooker said. ‘We are not quite sure yet which forms of finance will resonate most with customers. Our obligation is to try to develop those models.’

The CEFC has allocated up to around $270 million for small-scale solar, partnering with banks such as NAB, Commonwealth Bank, financiers such as FirstMac, solar companies such as SunEdison and Tindo Solar and utilities such as Origin Energy to try different financing approaches.

Brooker said many customers – households or businesses – don’t have available funds, want to manage cash flows, or use their capital elsewhere. That made options such as power purchase agreements, loans and other financing potentially attractive.

But because the technology did not have years of performance data, banks were reluctant to offer long-term loans, and their interest rates were higher than they might be.

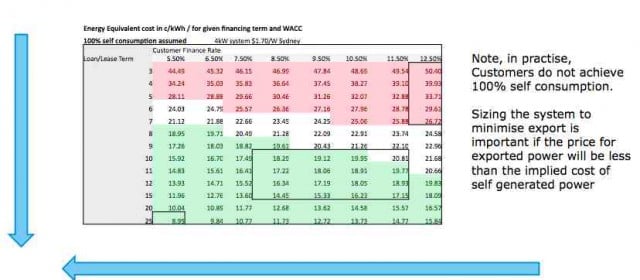

He produced this graph below to show the dramatic difference in the cost to consumers from various effective interest rates and length of loan profile. New financing models, like those supported by the CEFC, can bring down the cost of finance and extend the length of those loans. A high cost and short-term finance could result in a cost per kilowatt-hour five times more than a lower cost, longer-term finance.

Mark Twidell, the head of the Australian offshoot of global solar inverter giant SMA, said it was clear that the CEFC could help lower household electricity prices and provide a return to the taxpayer.

Mark Twidell, the head of the Australian offshoot of global solar inverter giant SMA, said it was clear that the CEFC could help lower household electricity prices and provide a return to the taxpayer.

‘It’s not rocket science,’ Twidell said. ‘We all know that banks are cautious, lending money to their customers for something new that they are worried might not work for long, it is something they call risk.

‘Risk means higher interest rates for loans that need to be paid back in a shorter period of time. Think speed boats, and cars and the like … this is how solar PV has been seen by banks. The result is the top right corner of the chart with solar electricity costs over 40c/kWh.’

Twidell noted that if banks see something working and can be confident in managing risks they will change their ways and lend money for longer periods and lower interest rates.

‘The CEFC also know that solar PV, unlike a car or speed boat, has no moving parts, comes with a 20 year warranty and is therefore going to have a risk profile more like a house. The result is moving towards the bottom left of the chart where solar electricity costs less than 10c/kWh.

‘So by doing nothing other than prove a PV system is more like a part of a house than a car in the driveway, the CEFC lower the cost of electricity for householders accessing a loan or finance product they have helped create.

‘Of course the consumer can buy the PV system directly, but we all know that without banks lending money there is a limit to what consumers and small business will buy.’

A further consequence of this move on the part of the Coalition government will be to shore up the interests of the already existing energy suppliers, effectively shifting the benefits of energy production away from individual households to already wealthy shareholders in limited liability, utility companies. With the imminent availability of relatively cheap, energy storage batteries and the risk that individual households will disconnect from the grid, the Coalition government seems keen to pre-empt any possible erosion of the financial interests of these companies. While there has been mention of promoting solar and wind farms, on the one hand unlikely because of aesthetic objections by prominent ministers, and yet possible insofar as such infrastructure could now only be financed by large corporate interests (and perhaps in conjunction with taxpayers’ money), the government’s environment fund is directed at best towards facilitating research into improved technologies for the coal industry. It is noteworthy too that this fund remains much, much smaller than the tax-payer funded subsidies already provided to the fossil fuel industry. In effect, this move to lock out individual households from the benefits of self-production correlates with the already entrenched trend to privatise publically-owned assets in the interests of already wealthy shareholders. No wonder the gap between rich and poor is increasing at an alarming rate. Social cohesion is under ever-increasing threat.

What a shortsighted paw paw Abbott is.

This is not just about their foolishness however

it is greed

there is profit to be made by this decision-at the expense of us all .

PROTEST!!! Loudly.

Financing available through installer companies. Subsidies by Taxpayers not needed or appropriate anymore.